The number of new EV sales grew by 16% year-on-year in February

The number of new electric car sales grew by 16% year-on-year in February, despite electric’s overall share of the market falling slightly. The overall number of new car registrations increased as the new car market showed the first marked signs of recovery since late last year. Unfortunately, it was not just new electric registrations driving this growth - new petrol sales, alongside new hybrid sales, were also up, helping to drive the uptick of the market.

⚡ What Our Data Shows

Ben Nelmes, Chief Executive Officer at New AutoMotive, said:

“It is great to see a growing number of people discovering the benefits of switching to an electric car - whether that’s the running cost savings, a better driving experience or doing their bit for the environment. The fact that there continues to be long waiting times for new electric cars underscores how consumers and businesses are embracing electric cars.

“To sustain the UK's progress towards electric transport, the government needs to try harder to increase the supply of electric vehicles to the UK. The upcoming Zero Emissions Vehicle (ZEV) mandate will incentivise manufacturers to sell electric cars in the UK, ensuring sufficient EVs enter the country or are produced in the UK.

“Finalising the mandate's specifics as soon as possible is essential given that it’s scheduled to take effect in 2024. Any delay to it being implemented would jeopardise the transition's pace, and punish drivers who want to switch to electric vehicles doing their part to reduce emissions.”

The full data release is available here. You can view the data on our interactive dashboard, here.

📈 UK market overview

New EV sales increased by 16%, while electric's market share dropped slightly year-on-year due to significant growth in petrol and hybrid sales. February saw the overall new car market grow by just under 20%, suggesting stability after a weak year. Despite some improvements, waiting times of up to 18 months persist for new electric cars, indicating high demand and limited supply. Meeting this demand is crucial for the UK's transition to electric transport, requiring a secure supply of EVs. The Zero Emissions Vehicle (ZEV) Mandate, set to take effect in 2024, will incentivize manufacturers to sell electric cars, ensuring adequate supply and expediting the country's transition. Finalising the Mandate's details promptly is essential to avoid delays.

Table 3 provides a full UK market overview, and will be updated from 3rd of the month, or the next working day after that.

📌 Regional highlights

The Peterborough DVLA area (which includes Cambridgeshire) tops this table with an impressive 51% of all cars registered in the area in February being electric. Oxfordshire was a close second, at 50%, whilst Wimbledon, within the London DVLA region, was third with 48%.

We track regional registrations using a three-month rolling average, which masks big variations in EV market share from month to month. The DVLA areas and regions with the highest share of EVs are as follows:

Peterborough - 51%

Oxfordshire - 50%

Wimbledon - 48%

Bristol - 34%

Birmingham - 28%

Manchester - 28%

Refer to tables 4 & 5 for full regional statistics, and will be updated from 3rd of the month, or the next working day after that.

🚗 The race for EV market share

Tesla regained dominance of the market in February, achieving the largest market share of any manufacturer and selling one in every five new electric cars registered in the UK. Audi came in second with just under 10% market share, doubling their electric vehicle sales from last February. Nissan, in 16th place, serves as a cautionary tale for other manufacturers as they only claimed 1.28% market share, despite their early success with the Nissan Leaf. The competition for the EV market is fierce, and companies must capitalise on their successes to become a dominant player.

For the full data, and year-on-year comparisons, refer to table 1 in the full release, which will be available from 3rd of the month, or the next working day after that.

📊 The brands who are quickest to electrify

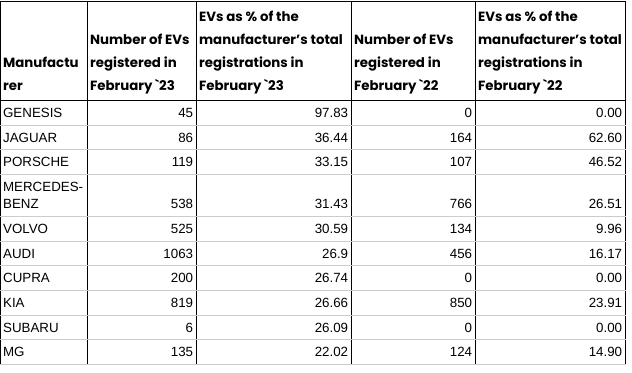

According to the table for February, it is evident that electric cars have become a crucial and central part of the business for many reputable and large manufacturers. Among the top 9 manufacturers listed, including heavyweights like Audi, Volvo, and Mercedes-Benz, at least one in four sales in February were for fully electric vehicles. Although the top three manufacturers, which are niche brand Genesis, Jaguar, and Porsche, have relatively low sales volumes, several high-volume manufacturers have successfully transitioned significant segments of their sales to electric. Mercedes-Benz, in fourth place on this table, had 31% of its sales in February from an EV, while Volvo (5th place), Audi (6th place), and Kia (9th place) had just over one in four of their cars sold as electric. The fact that these high-volume manufacturers continue to electrify their cars shows that they are aware of the growing number of consumers who prefer electric vehicles as their first choice.

We exclude brands that are 100% electric from this table since they do not need to electrify their sales. For the full data, refer to table 2 in the full release, which will be available from 3rd of the month, or the next working day after that.

About Electric Car Count

Electric Car Count is a monthly data series from New AutoMotive, a not-for-profit independent transport research organisation with a mission to accelerate and support the UK’s transition to electric vehicles. You can find out more about New AutoMotive by visiting www.newautomotive.org/mission

Electric Car Count provides an overview of the newly licensed passenger cars. It is released monthly, in the first few days of each month, providing data on the previous month’s newly licensed cars. In the UK, vehicles must be licensed (also known as registered) to be legally driven on UK roads.

We provide an overview of the state of the market, showing the number of cars registered by each manufacturer, broken down by fuel type. This provides a new way to track the transition to EVs in the UK.

Visit our interactive data dashboard here: www.newautomotive.org/ecc

For more background information on the statistics we provide, you can read our blog about the race for EV market share: www.newautomotive.org/blog/the-race-for-ev-market-share-is-under-way

Data sources & methodology

The data is shows the number of type M1 vehicles (i.e. passenger cars) in the DVLA’s vehicle licensing database as it stands on, or shortly after, the 1st day of the month. The DVLA’s vehicle licensing database is the legal record of all vehicles licensed for use in the UK. We obtain the data from the DVLA’s vehicle enquiry service API, and the DVSA’s MOT history API.

The data covers all cars with a standard form UK vehicle registration mark (VRM, i.e. the vehicle’s number plate), but does not capture any vehicles with personalised VRMs.

Terminology

We use the following terms to refer to vehicle fuel types:

Pure electric: battery electric, or other purely electric-powered vehicles (such as hydrogen). These are vehicles where the drivetrain of the vehicle is only electric, with no facility to drive using a fossil fuelled engine.

Hybrid: vehicles that have the ability to drive under electric power or under fossil fuel power. These include vehicles classified by the DVLA as “hybrid electric”, “electric diesel”, for example.

Q&A

Why are the numbers different from other organisations, such as the SMMT?

Our numbers are typically slightly different from those published by the SMMT. We cannot speculate as to why this is because the SMMT do not publish the methodology for obtaining their vehicle data.

Our data is based on the DVLA’s legal record of vehicles licensed as it stands on the first of the month.

Our methodology does not capture newly registered vehicles with a personalised number plate. These take longer to appear in our database, and are not included in the monthly release. We do not believe that these are a statistically significant part of the market.

Will you make this data open and accessible to more organisations?

Yes, we are happy to supply the data to anyone where doing so will not conflict with our mission. We encourage people to reach out to us on data@newautomotive.org.