Shift to Reverse: Washington’s EV Retreat Continues

Last week, the OBBBA (the One, Big, Beautiful Bill) eliminated the federal EV incentive, marking a turning point in U.S. climate and transport policy. That blow was compounded by a successful Congressional Review Act challenge to California’s cornerstone vehicle emissions waiver - a move that destabilises the country’s most important regulatory framework for clean cars. Together, these actions capture the “drill, baby drill” mood shaping Washington’s agenda and sending shockwaves through global markets.

The Great EV Rollback

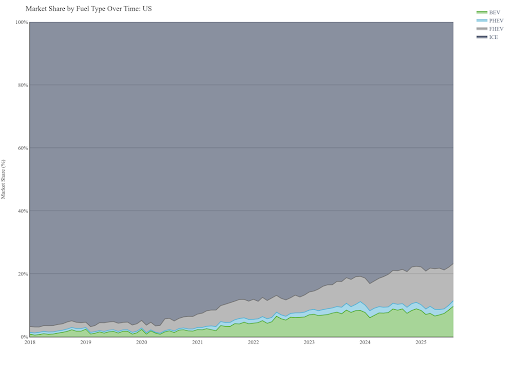

The withdrawal of the federal EV incentive - which offered up to $7,500 for new passenger EVs and as much as $40,000 for qualifying commercial vehicles - is perhaps the most visible blow to U.S. EV policy in 20251. What makes this especially jarring is that it’s happening seven years earlier than planned for. As expected the new car market has ticked up in the last few months (rising to 8% of the market in August 2025 and nearly 10% in September) as motorists take advantage of the dying days of the scheme2. It is unclear whether some manufacturers may offer discounts themselves after the rollback commences.

Adding insult to injury, the OBBBA introduced a new carve-out: interest paid on vehicle loans for personal-use cars with final assembly in the U.S. is now tax deductible (up to $10,000 annually)3. While this deduction theoretically applies to some EVs that meet the “assembled in U.S.” requirement, it also applies broadly to gasoline and diesel trucks and SUVs. This gives the incumbent traditional internal combustion technology a fresh financial leg up just as targeted EV incentives vanish.

California Under Siege

If the end of federal incentives was a body blow, the attack on California’s clean air authority may prove to be a knockout punch for now. For decades, California has used a special waiver under the Clean Air Act to set stricter vehicle standards than Washington, with 17 other states following its lead. Together, that framework covers around 40% of the U.S. car market, the backbone of America’s EV rules4.

That foundation is now cracking. In May, Congress invoked the 1996 Congressional Review Act to overturn the EPA’s approval of California’s latest zero-emission rules (ACC II for cars, and the ACT rule for trucks)5. The Department of Justice argues the CRA move is binding and non-reviewable, even if the waivers weren’t meant to be covered by the law. If the courts uphold this, it could strip California - and every state that follows it - of their ability to enforce ZEV mandates6.

California is fighting back hard. Governor Newsom has already signed an executive order reaffirming the state’s ZEV commitments and tasked regulators with finding new ways to keep momentum alive, from incentives to infrastructure7. CARB has even dusted off older emissions standards (LEV III) as a fallback, ensuring that something enforceable is in place if the courts side with Congress8.

But the damage is already being done: the legal uncertainty alone makes it nearly impossible for carmakers to plan long-term EV strategies in the U.S. If the CRA challenge stands, it doesn’t just undercut California - it unravels the entire regulatory architecture that nearly half the American market depends on.

Why stop there?

The policy shake-up doesn’t stop with EV incentives. NEVI (National Electric Vehicle Infrastructure) funding was cut under the OBBBA in February, before being reopened in August, slowing the rollout of charging networks across the country9. Meanwhile, the bill phases out or restricts a wide range of clean energy tax credits, for charging, wind, solar, and more, years ahead of the original schedule10. On top of that, there is growing speculation that the EPA and Department of Transportation may review or roll back other clean-air regulations, fuel economy standards, and pollutant limits11. All of which would have seemed like far-fetched speculation a year ago, but today feels like an all too real possibility.

What does it all mean?

For U.S. OEMs, the federal retreat from EV policy has triggered a recalibration rather than an outright collapse. GM is delaying model launches and leaning harder on its profitable gas line-up, and Ford has cancelled big-ticket EV projects12. At the same time, core bets remain intact: Ford’s Tennessee “mega-plant,” GM’s $4 billion U.S. manufacturing push, and industry-led charging partnerships all point to a recognition that electrification cannot be abandoned, only slowed. The result is a patchwork approach - trimming ambition where margins are thin, while doubling down where scale and competitiveness demand it.

Globally, this hedging creates ripple effects. The uncertainty in the world’s second largest car market emboldens oil majors and risks weakening investment signals for critical minerals, batteries, and clean energy projects. Chinese and European rivals, still backed by stronger state incentives and regulatory clarity, are moving ahead, threatening to capture market share that U.S. firms hesitate to chase.

At the same time these signals have allowed oil companies to quietly and quickly switch strategies, BP has cut its renewable spending by half and increased its spend on oil and gas13. Norwegian owned Equinor is pulling back its renewables investment while increasing oil targets14 and in the first quarter of 2025 companies cancelled or downgraded clean energy projects by nearly $8 billion in the USA15.

In other words, America’s EV transition is no longer a one-way bet: policy rollbacks have left its manufacturers caught between retreat and renewal, and the rest of the world is adjusting to a slower, more uneven U.S. trajectory.

1 The Independent, Trump is ending the tax credit for electric vehicles. Experts warn sales will ‘crater’ Accessed: October 2025

2 New AutoMotive, Global Electric Vehicle Tracker. Accessed: October 2025

3 IRS, One, Big, Beautiful Bill Act: Tax deductions for working Americans and seniors. Accessed: October 2025

4 Congress.gov California and the Clean Air Act (CAA) Waiver: Frequently Asked Questions Accessed: September 2025

5 World Resources Institute. STATEMENT: U.S. Senate approval of resolutions to overturn California’s Clean Air Act preemption waivers throws progress into reverse. Accessed: September 2025

6 Freight Waves. Federal government fires back in court over California waiver cancellation Accessed: September 2025

7 Governor Gavin Newsom. Governor Newsom signs executive order doubling down on state’s commitment to clean cars and trucks, kickstarts next phase of leadership Accessed: September 2025

8 Heavy Duty Trucking. What Standards Apply? CARB Moves to Clarify Emissions Rules Amid Legal Limbo. Accessed: September 2025

9 EVCandi US government restarts US$5bn NEVI program. Accessed: October 2025

10 Husch Blackwells. OBBBA Renewable Energy Provisions: Frequently Asked Questions. Accessed: October 2025

11 EPA. EPA Launches Biggest Deregulatory Action in U.S. History. Accessed: October 2025

12 Auto News Ford cancels 3-row EVs, delays next-gen electric pickup in $1.9B strategy shift. Accessed: October 2025

13 BBC News, BP shuns renewables in return to oil and gas. Accessed: September 2025

14 Financial Times. Equinor scales back renewables push 7 years after ditching ‘oil’ from its name Accessed: September 2025

15 Oil and Gas 360. Firms cancel $8 billion in renewables investment on Trump policies Accessed: September 2025